The explosion at Beirut Port in Lebanon has much impact on the country and shipping companies?

The explosion in Beirut port is likely to severely damage the country’s container supply chain and threaten the country’s ability to import essential goods.

This also dealt a severe blow to the French container giant CMA CGM.

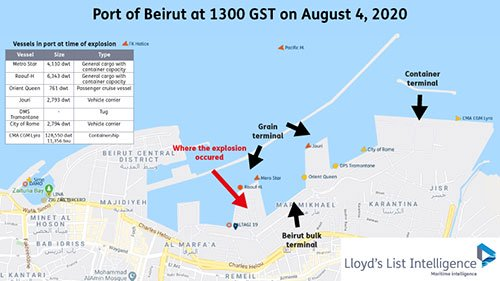

Air France, which is closely related to Lebanon, had a ship in the port when the explosion occurred. This was a 11,400 TEU CMA CGM Leila.

CMA CGM stated in a statement that the ship was 1.5 kilometers away from the explosion site and was not damaged and no crew members were injured.

The shipping company’s excellent shipping headquarters in Beirut was severely damaged. Of the 261 staff in the city, two were seriously injured and one was missing.

CGM and its affiliated CEVA logistics department have provided logistics and maritime assistance to the Lebanese and French governments in order to respond to emergencies.

Libya has established an operational organization and a logistics center in Tripoli. All ships will be transferred to Tripoli or other terminals in the area until further notice. The organization stated that in order to maintain business continuity, it has established three recovery points, two of which are in Beirut and one in Tripoli.

Other shipping companies are also rapidly developing emergency plans. hapago-lloyd's office in Beirut was completely destroyed in the explosion. At the time of the explosion, the company had no ships in Beirut, but he told the client that most of the full and empty containers in the port might have been swallowed by the explosion.

The German shipping company stated that the 2760 teu Fleur N deployed on Levante Express has cancelled the call originally scheduled for August 7 in Beirut. The conventional imported cargo carried by the ship will be unloaded at Damietta in Egypt.

In its East Med Express, the 6300 TEU APL Norwegian will also cancel its call in Beirut on August 7 and transfer to the Lebanese port of Tripoli for unloading.

The agency office of another company, Grimaldi, was completely destroyed. The company stated that one of the ships will arrive in Beirut on Sunday. This ship, which is also usually bound for Tripoli, may unload there, depending on the development of the situation. Neither company reported any employee casualties.

Earlier, Maersk said its office was damaged and three employees were injured, but they were discharged from the hospital on Tuesday night.

Mediterranean Shipping Company (Mediterranean Shipping Company) had not yet entered the port at the time of the explosion. It has notified its customers that it will use several alternative ports to transport Lebanese cargo before the Beirut container terminal is put back into operation. These include Gioia Tauro, Tekirdag, Mersin and Piraeus. At the same time, the staff was told to work from home.

Beirut is an important container port in Lebanon. Although the extent of damage to the container terminal is still unknown, damage to the surrounding port infrastructure may severely affect throughput.

Dinamar consulting firm Frans Waals told Lloyd’s Register of Shipping: “The exploded silo is about 1.5 kilometers away from the main terminal of the container terminal. This is not too far in itself. On the other hand, the distance may not be too far. It will damage all critical infrastructure."

Limited container capacity

The port's throughput in 2019 was 1.2 million TEUs, and Lebanon will strive to replace this capacity in other ports. Tripoli has only 600 meters of quay space and two cranes, while Beirut has 1,100 meters of quay space and 16 cranes. The annual capacity of Tripoli is only 400,000 teu.

The terminal can serve up to 18,000 TEU ships, although small feeder vessels account for most of the terminal’s business.

"The irony is that if Lebanon does not want to rely on Israel, its only option is Latakia in Syria," Vals said.

According to data from sea intelligence, only four major ocean-going service companies make stops in Lebanon, and three of them are destined for Beirut. Among them, 2 million AE20/Dragon services are currently suspended, leaving the Ocean Alliance BEX and MX1 services as the only direct stop in Beirut.

The collapse of the Lebanese economy and the collapse of demand caused by the pandemic meant that only three ocean shipping lines called Rout in June, compared with 12 in the same period last year.

But the port plays an important role in the Eastern Mediterranean transshipment and feeder services. CMA CGM and Mediterranean Shipping Company are the main customers of container terminals, responsible for more than 80% of the transshipment cargo.

CMA CGM has a regional headquarters building near the port in the center of Beirut, and provides 6 feeder services for the interior of the Mediterranean and Northern Europe.

As part of the government's privatization plan, the Beirut Port Authority (Beirut port authority Gestion et Exploitation du port de Beyrouth) earlier this year called for an international bid to obtain a concession to manage, operate and maintain the Beirut container terminal.

The bidding should take place at the end of March, but Lloyd’s understands that the delay caused by the epidemic means that the process has been postponed at least until the end of this year.

CMA CGM provides one-third of the terminal’s business and was once considered a possible bidder, but with the entire port being damaged, the prospects of the privatization plan are currently doubtful.